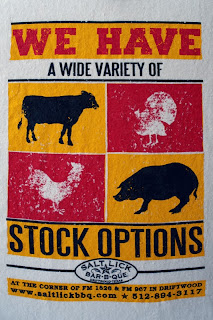

Options

Alex McCaw wrote an excellent blog explaining stock options - http://blog.alexmaccaw.com/an-engineers-guide-to-stock-options . Everyone getting options (an engineer or not) should read this - especially the tax implications of converting your options. I thought there were several common issues that could use some further explanation using an example. For our example, lets say a VC investment made of $10 M at a valuation of $50M. Pre Money and Post Money Valuation. Since people like big numbers, so this is usually expressed as post-money. So the company was valued at $40M before the investment, but now that they have another $10M in the bank, they are now worth $50M. Dilution. Before the investment there were 4,000 shares/options, each worth $10, and each representing 1/4,000th of the company. For the investment another 1,000 shares were created and sold to the investors at $10 each. Each share/option each employee had was worth $10 before and $10 after - so there w