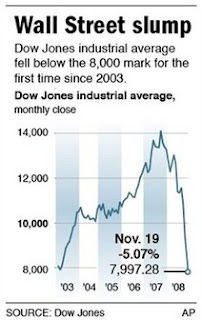

Sub 8000

The DJIA went below 8000 today. A financial person told me that if you listen to the sage advice of Buffet, Lynch, etal, then you will invest now because it is tough to time market bottoms.

But I just saw a headline that makes me thing we have not hit bottom yet. The title was "Dow falls below 8,000, S&P at 5-year low". If this is the worst financial crisis since the Depression, and it is much broader than the 2000-2003 meltdown, then why would the stock market not reflect that? IMHO the world economy is far worse with no real tangible turnaround on the horizon in spite of the Goverment's efforts to free up the money supply and increase the velocity of money. So the stock market is in for more downward trends...

Comments

http://1.bp.blogspot.com/_pMscxxELHEg/SSSevkxwNtI/AAAAAAAADzE/V_BMgbRML4E/s1600-h/four-bears-large.gif

I think there are similarities to the 70's. The high in Jan. 1973 was 1,067. The low in Oct. 1974 was 563. The Dow did not get back to 1,067 until Nov. 1982. 10 years - and during those 10 years inflation was pretty high. I recall money market funds returning over 10% per year for several of those years... Ugly. It did get back above 1,000 several times in between. You can see a partial snapshot of that ugly era here http://stockcharts.com/charts/historical/djia19601980.html.